Please Enter below the LTP (after 9.30 a.m) of the NSE/BSE Nifty or any Index or Stock script for which you need to calculate Intraday Resistance and Support levels as well as Stock Targets and Stoploss recommendation based on

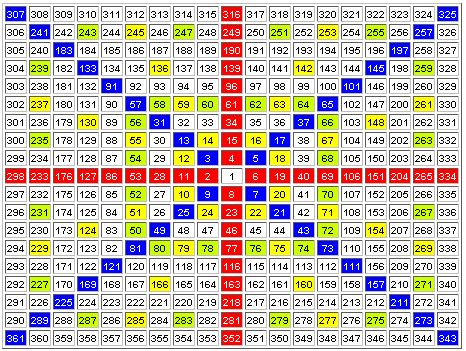

The Gann Square of 9 is One Of The incredible Discoveries Of WD Gann. The Essential Gann Square Is The Square Of 9 Also Known As Square Root Calculators. It Involved Spiral More Often referred to As Wheel. Gann Don’t Invent The Square Of 9 For Day Trading Purpose. Watch this presentation that Market Analyst’s founder, Mathew Verdouw, did for the MTA on the theory behind the Gann Square of 9. Mathew explains how to read the basic information off the Square of 9 chart and also how to apply the Square of 9 tools that are available in Market Analyst. The Definitive Guide to Forecasting Using W.D.Gann's Square of Nine Mathematical Principles of the Square of Nine Odd Square Numbers Page 5 On Figure 5, there is a circle around each odd square number. These numbers are 9, 25, 49, 81, 121 and so on. The number 9 is the square of 3, The next numbers are the squares of 5, 7, 9, and 11. Hence, it is called the Square of 9. Circumscribed around this spiral number grid are the dates of the year. The true origin of the Square of 9 is unknown, but we know for certain is that Gann used the Square of 9 and considered it very valuable. The concept behind the Square of 9 is that growth is not linear. Gann Square Of 9 Calculator How To Use Gann; Gann Square Of 9 Calculator Free Pivot Point; This made it possible for Mr. Gann to determine not only when a trend change was imminent, but also what the best price would be to enter, or exit that market.He made 286 trades in a period of 25 market days.

Gann's Square of Nine method. Also see below Casestudy if you want to know how it worked for me.

method. Also see below Casestudy if you want to know how it worked for me.| Enter LTP: >> | ||||||

| Gann Square of 9 | ||||||

| 18.06 | 19.14 | 20.25 | ||||

| 10.56 | 11.39 | 12.25 | ||||

| 10 LTP | 5.06 | 5.64 | 6.25 | |||

| 17.01 | 9.76 | 4.51 | 4 | 6.89 | 13.14 | 21.39 |

| 9 | 8.26 | 7.56 | ||||

| 16 | 15.01 | 14.06 | ||||

| 25 | 23.76 | 22.56 | ||||

The Gann's calculated Resistance and Support levels for the provided LTP value above is as given below for Intraday only.

| Resistance & Support Levels | ||||||

| Resistance 1 | Resistance 2 | Resistance 3 | Resistance 4 | Resistance 5 | ||

| 11.39 | 12.25 | 13.14 | 14.06 | 15.01 | ||

| Support 1 | Support 2 | Support 3 | Support 4 | Support 5 | ||

| 9 | 8.26 | 7.56 | 6.89 | 6.25 | ||

You can use the below Gann's Recommended Targets and

Gann Square Of 9 Excel True Up Meaning

Stoploss for the stock/Index for Intraday only.| Recommendation: Buy at / above: 10.56 Targets: 11.38 - 12.24 - 13.13 - 14.05 Stoploss : 9.76 Sell at / below: 9.76 Targets: 9 - 8.26 - 7.56 - 6.89 Stoploss : 10.56 |

GANN Square of 9 FAQ

What is a GANN Calculator or GANN Square of 9 Calculator?The GANN Square is derived from Spiral Chart by GANN. The GANN square of 9 is a 9×9 grid. There is a “start number” and defined increments from this “start number” ultimately create the spiral square. This theory is mainly used in an intraday calculator and is very easy to use. Use our GANN calculator below. Mobile users need to scroll horizontally to see the full calculator below.

Does Gann Square of 9 works?GANN theory is a way to mathematically represent the supports and resistances in the market. Since we started observing this theory from 2009 I have seen it has an uncanny accuracy for intraday trading. No technical knowledge is required. It is simply a “set and forget” method to trade.

What is Gann Theory?Square Of Nine

GANN Square of 9 means there is 9 x 9 = 81 numbers in a geometrical structure. It has seen that the price pattern follows a certain geometrical pattern. W. D. Gann formulated these patterns in his theory of the technical analysis and this is known as the GANN theory.